MassMutual Ascend: A Tool for Financial Professionals

As a financial professional, staying up-to-date with the latest tools and resources is essential to providing your clients with the best possible advice and guidance. One such tool that has been garnering attention in the investment community is MassMutual Ascend. This platform is designed to help financial professionals streamline their processes, optimize their workflows, and ultimately provide better service to their clients. In this blog, we'll explore the features and capabilities of MassMutual Ascend and how it can benefit you as a financial professional. Whether you're an experienced advisor or just starting in the industry, read on to discover how MassMutual Ascend can help take your business to the next level.

1. Introduction of MassMutual Ascend

When it comes to planning for the future, MassMutual Ascend is a valuable tool for financial professionals. As previously mentioned, this platform provides a personalized financial wellness score for users, helping them assess their overall financial situation and offering guidance to reach their goals. With a strong history of financial strength and stability, MassMutual has established itself as a trusted provider of fixed, fixed-indexed, and registered index-linked annuities. Additionally, their website offers helpful resources for financial planning and education, such as finding a financial professional and calculating college savings or disability income. Overall, MassMutual Ascend is a valuable asset for financial professionals looking to offer their clients comprehensive and trustworthy financial planning solutions.

2. Services offered by MassMutual Ascend

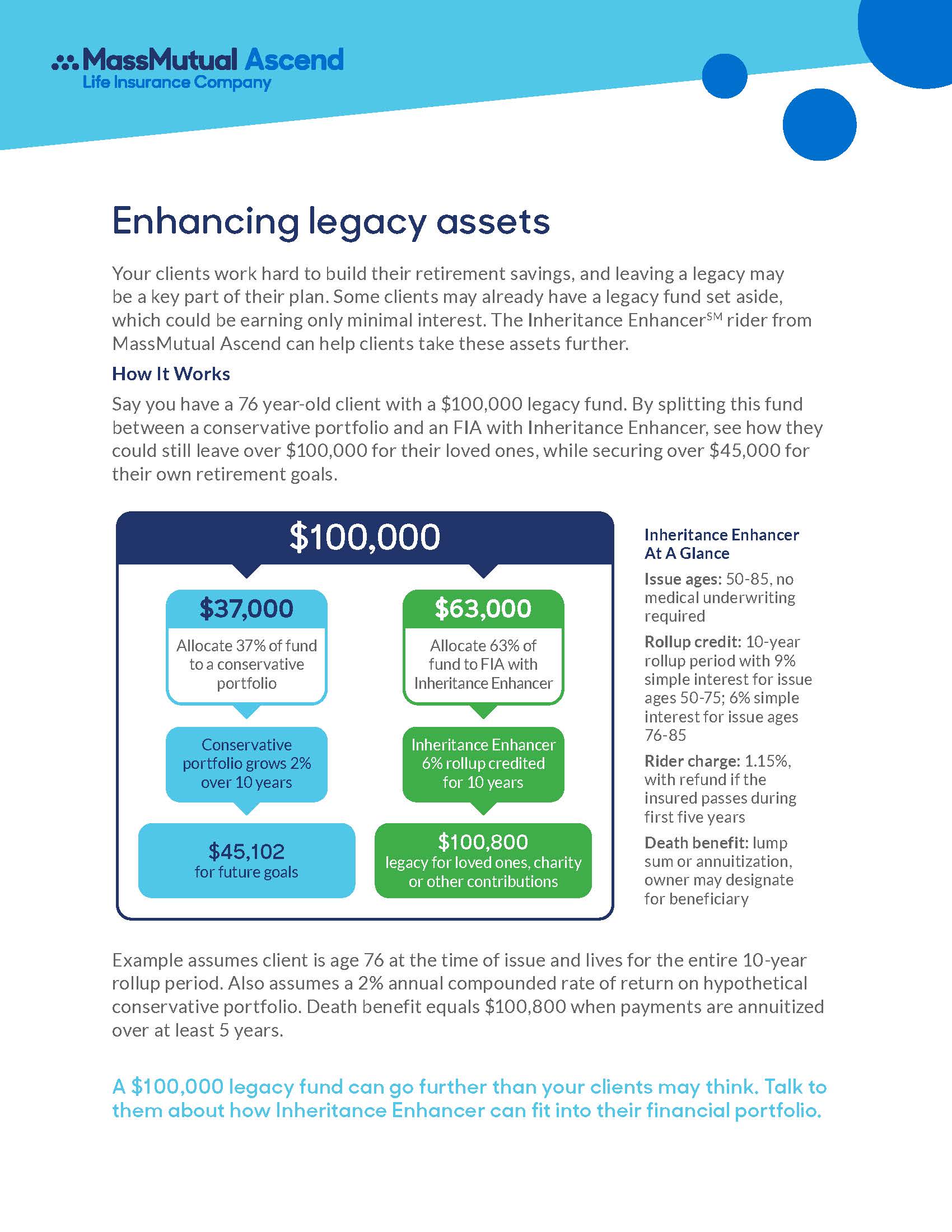

MassMutual Ascend offers a variety of services that can be powerful tools for financial professionals. In addition to providing fixed, fixed-indexed, and registered index-linked annuities, the company also offers financial planning insights and resources to help clients achieve their goals. Whether it's retirement planning or simply looking to build wealth, MassMutual Ascend can assist with customized solutions based on each client's unique needs. The Annuity Quiz tool is an additional resource available to help financial professionals assess clients' risk tolerances and determine what type of annuity may be the best option for their future. With a partnership with MassMutual, financial professionals also gain access to no-load fixed-indexed annuities for their clients. These services serve as valuable resources for financial professionals looking to provide comprehensive financial planning options to their clients.

- MassMutual

- MassMutual Offers Life Insurance and Retirement Planning Services - New!

- MassMutual announces additional $100 million fund to invest in diverse-led and overlooked companies - MassMutual - New!

- MassMutual: A Company That Has Grown Beyond Life Insurance - New!

- MassMutual: A Springfield-based Life Insurance Company

- MassMutual: One of the Largest Life Insurers in the US - New!

3. Financial planning insights and resources

In addition to their various products and tools, MassMutual offers a wealth of financial planning insights and resources for their clients. These include articles, guides, and calculators to help individuals better understand and plan for their financial future. For those nearing retirement, the annuity quiz tool can provide valuable guidance on investment options. Plus, MassMutual's partnership with Great American Life Insurance Company offers access to no-load fixed-indexed annuities. Financial professionals can also benefit from the platform's resources, with monthly goal planning and strategic distributor support available. Regardless of where someone is on their financial journey, MassMutual Ascend offers the tools and knowledge necessary to help them achieve their goals.

4. Annuity quiz tool for retirement planning

The MassMutual Ascend offers an annuity quiz tool that helps individuals plan for their retirement. This tool asks a handful of quick questions to help users determine how much they can afford to contribute to their retirement plan. It's like having a GPS on a journey - this tool guides users on their path to a comfortable retirement. As part of MassMutual's commitment to helping individuals reach their financial goals, this annuity quiz tool is a valuable resource for anyone looking to secure their future. Combined with the other services that MassMutual Ascend offers, individuals can gain financial planning insights and resources that can help them make informed decisions about their retirement. Additionally, MassMutual's partnership with no-load fixed-indexed annuities means individuals have access to top-rated insurers and online applications, making the retirement planning process even easier.

5. Partnership with MassMutual for no-load fixed-indexed annuities

As mentioned earlier, MassMutual Ascend offers various annuity products to help consumers build guaranteed income for retirement. They have now partnered with MassMutual to provide no-load fixed-indexed annuities to their clients. These annuity products offer lifetime income that is protected from market loss, ensuring financial security for retirees. MassMutual Ascend also offers customized products, operations, tech, and marketing support to its clients. Through their partnership with MassMutual, they can continue to provide industry-leading annuity products while catering to the unique needs of each individual client. With their commitment to taking their clients' financial futures above, MassMutual Ascend helps financial professionals secure more financial security for their clients.